Sponsored Content

Online Training and the Post-Pandemic Fitness Landscape

Insights into the rapid growth of the online personal training sector and post-pandemic trends.

There’s no doubt that the COVID-19 pandemic has had a profound impact on the global fitness industry. With widespread closures of brick-and-mortar training centers and a temporary halt to in-person sessions, personal trainers and gym owners alike have had to make rapid adjustments to the “new normal,” including innovative adaptations to training and interacting with their clients. As a result, the industry as a whole has seen a huge shift towards hybrid and online training business models, with the online industry projected to achieve the highest total growth rate of all fitness sectors at 33% per year between 2021 and 2028 (Rizzo 2021).

With increasing numbers of potential customers working from home and opting for virtual rather than gym-based classes, personal trainers and gym owners have adapted around the Zoom Boom to diversify their revenue streams, program remotely and interact with their clients in a progressively “contactless” world. With the rise of software solutions, live-streaming and popularity surge in fitness wearables—ownership of which has tripled in just 3 years!—technology is fast-becoming an essential component of the modern fitness industry (Statista 2022). Although this might seem like a daunting prospect to some, the undeniable reach of internet technology now means that fitness coaching is more accessible, instantaneous and bespoke than ever before, giving the industry global insight into what clients are looking for and how best to help them to achieve their goals.

How Did the Industry React During the Pandemic?

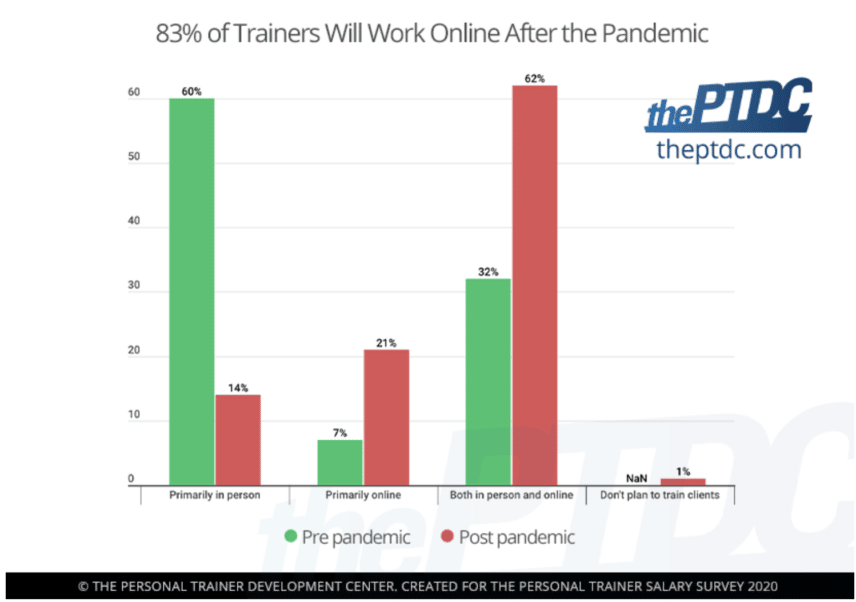

Before the pandemic, just 39% of personal trainers reported that their business involved some aspect of online training. By August 2020, that number had more than doubled to 83% (Goodman 2022). Interestingly, when trainers were surveyed about how their business would operate after the pandemic, only 14% responded that they’d be working primarily in the gym, a 75% drop from previous levels (My PT Hub 2021).

Statistics show similar shifts towards online solutions for the club and gym industry. With losses of $29.8 billion since the start of the pandemic in the U.S. alone, health clubs and studios were forced to quickly adjust their business models to include online training components to accommodate unpredictable and unforeseen restrictions (Club Industry 2021). When surveyed about the permanent changes to their business models (post-COVID) to improve their value propositions, the top club owner responses were in favor of: offering a mobile application with pre-made videos and programs (54%), creation of an online platform (54%) and offering hybrid/flexible subscription plans (36%) (Huguet 2021). When narrowing down a single action required to overcome the crisis, the most popular resolution with a staggering 72% of responses: the digitalization of coaching (Huguet 2021).

Where Does the Fitness Industry Stand Now?

The good news is that the fitness industry as a whole is bouncing back fast and is expected to grow by 172% by 2028 (Rizzo 2021). Despite the reopening of gyms and studios, it’s clear that online training—whether adopted by necessity or choice—has become a key component of the industry and will continue to play a pivotal role in how we train, interact with and manage our clients.

Following the reprioritization of global health in the wake of the pandemic, the fitness industry has never been in a better position to provide the essential tools and education for clients to achieve both physical and mental wellbeing. With 68% of Americans reporting that they plan to continue using the online fitness services they started during the pandemic, the online sphere provides huge opportunities for business growth and encouraging signs of progress within the fitness sector (IHRSA 2021).

References

Club Industry. 2021. 22 percent of gyms have closed, $29.2 billion revenue lost since COVID-19 hit. clubindustry.com/industry-news/22-percent-gyms-have-closed-292-billion-revenue-lost-covid-19-hit.

Goodman, J. 2022. How big Is the online personal training industry? Personal Trainer Development Center. theptdc.com/articles/how-big-is-online-personal-training-industry.

Huguet, L.C.T. 2021. Business model reinvention: impacts of COVID-19 on the fitness gym industry. ISCTE Business School. repositorio.iscte-iul.pt/bitstream/10071/24161/1/master_lea_tiphaine_huguet.pdf.

IHRSA (International Health, Racquet & Sportsclub Association). 2021. 2021 IHRSA media report. ihrsa.org/publications/2021-ihrsa-media-report.

My PT Hub. 2021. How to grow your online fitness business during the pandemic. mypthub.net/blog/5-ways-to-grow-your-online-fitness-business-during-the-pandemic.

Rizzo, N. 2021. Fitness industry statistics 2021-2028 [market research]. Run Repeat. runrepeat.com/uk/fitness-industry.

Statista. 2022. Wearables unit shipments worldwide from 2014 to 2021. statista.com/statistics/437871/wearables-worldwide-shipments.