Basic Accounting Principles for Fitness Professionals

Accounting is an important part of any

business. It provides the financial snapshot we need in order to make informed

decisions regarding the current and future health and performance of our

business. If you expect your own fitness business to grow and flourish, you

will need to possess more than just a passing knowledge of accounting

basics.

Accounting is not something that most fitness professionals

consider before starting in this industry. However, if you are even just

thinking of striking out on your own, it is time to dip your toes in the water

in terms of getting a handle on the accounting process. Where should you start?

The best place is with the basics, from terms commonly used by financial

experts to the underlying concepts that govern any successful business. That

said, the information contained in this article is general in nature, and

readers should always consult their own accountant or tax preparer before

implementing any principles or methods discussed here.

Terminology and General Principles

Anyone

considering business ownership should have an understanding of basic accounting

terminology and general principles. The first step is to become familiar with

the “lingo,” so to speak. For example, you should know the meaning of terms

such as transactions,

credits, debits, assets, liabilities, expenses, cash flow, accounts payable and

accounts receivable. For explanations of

these and other salient terms, see the sections that follow and/or the

“Glossary” sidebar. Furthermore, you need to understand the steps involved in

using a proper, consistent accounting method to handle transactions. You should

also become acquainted with a few basic accounting principles required to

maintain, update and balance your accounts, such as knowing what a particular

financial ratio can tell you about the health of your business.

Accounting Method

An

accounting method determines how

and when you will record your business expenses. Cash

accounting and accrual

accounting are the two main

accounting methods. Although the methods are similar, they differ on one

significant issue: the timing of when

transactions are recorded.

For most fitness professionals, cash accounting is typically

recommended. The cash method is easy to maintain because you don’t record any

income until you actually receive the cash due, and you don’t record an expense

until the cash is paid out. For example, you would record membership dues the

day you actually received the payment from the client. Contrast this with the

accrual method, in which you would record the transaction the day you sent out

the bill or when payment was considered due. The accrual method also requires

many more transactions than the cash method and is thus more time-consuming and

more prone to error.

If your business makes less than $5 million per year in sales,

the Internal Revenue Service (IRS) pretty much allows you to choose which

accounting method you want to use. However, if your business stocks an

inventory of products that you will sell to the general public, the IRS

requires that you use the accrual method. According to the IRS, inventory

includes any merchandise you sell, as well as supplies you later resell at your

facility.

Regardless of which accounting method you ultimately select, it

will provide only a partial picture of your business operation’s financial

status. While the accrual method illustrates the in-and-out flow of business

income and debts more accurately than the cash method, accrual accounting may

leave you clueless as to the cash reserves available at any time. This, in

turn, could result in a serious cash flow problem. For example, your income

ledger might show thousands of dollars in sales, while in reality your bank

account contained only a couple of hundred dollars because your customers had not

paid you yet.

On the flip side, while the cash method may provide a truer

picture of how much actual cash your business has in the bank, this method can

often be misleading in terms of longer-term profitability. For instance, your

books might show that a single month was highly profitable, when in actuality,

sales were slower and several of your customers just happened to pay their

outstanding bills that month.

Debits and Credits

Debits and

credits are the basics of any business accounting system. They are the means by

which you record all transactions for your business. Whenever you record a

business transaction, you need to show it as both a credit and a debit. If you don’t, the entry will be out of balance,

which is not good, because it will ultimately throw off your financial

statements. This type of record keeping is known as a double-entry

ledger system.

A debit

entry is used to show an increase of an asset or expense, or

a decrease of a liability, owner’s equity (capital) or income. A credit entry

denotes an increase of a liability, owner’s equity (capital) or revenue, or a

decrease of an asset or an expense.

Here is how it would work in the real world: let’s say a client

purchases products at your fitness facility in the amount of $75 and pays you

by check. In your general ledger, you would record the transaction in the

following way:

Debit $75.00 cash |

Credit product sales |

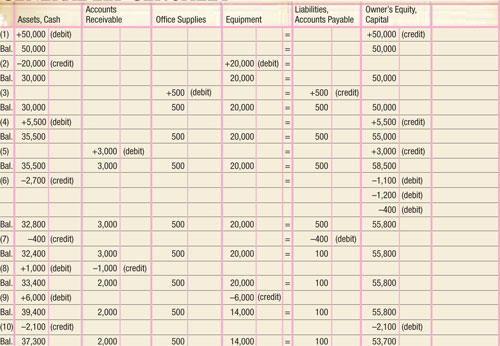

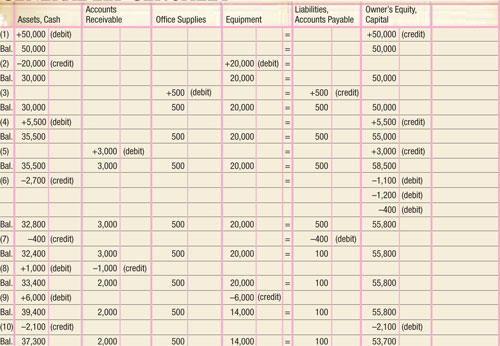

See the sidebar “Sample Business Ledger Sheet” for a more

detailed example of how debits and credits are recorded.

Income & Expenses

Income usually refers to the money you receive as a result of

normal business activities. For example, most fitness professionals receive

money from club memberships, personal training sessions/consulting and/or

product sales. An expense, on the other hand, generally refers to an outgoing payment

made by a business, such as rent, utilities or employee salaries.

For each of your income streams and expenses, you will need to

create an account that allows you to record and track exactly how much you are

generating in sales and paying in expenses.

If you offer several services and/or products at your fitness

facility, it is wise to establish an income account for each. This way, you

know what exactly is generating your income. By adding all income categories

together, you will be able to quantify the total revenue of your business.

For instance, if you derive income from memberships, individual

training sessions, group classes and product sales, you may want to develop

four separate income accounts, as follows:

- sales revenues from

memberships - sales revenues from

individual training sessions - sales revenues from

group classes - sales revenues from

product sales

The same basic principle applies to expenses, meaning you would

create separate accounts for rent, telephone, electricity, etc.

When recording transactions for these accounts in your general

ledger—which represents the summation and repository of all financial

transactions undertaken by a business entity—you would use credits to increase

your income accounts and debits to decrease them. If these were expense

accounts, you would use debits to increase the accounts and credits to decrease

them.

Assets and Liabilities

Assets refer to items of value that your business owns. For

example, the cash in your bank account is considered an asset, as is money owed

to you (i.e., accounts receivable) or any fitness/office equipment or real

estate that your business owns. Contrast assets with

liabilities, which are any debts or

obligations you owe to others. Examples of typical liabilities in a fitness

business may include bank loans, payments due to vendors, rent, telephone

service, payroll, laundry service, etc.

There is a general rule of thumb when working with assets and

liabilities: increase assets with a debit, and decrease them with a credit.

Increase liabilities with a credit, and decrease them with a debit. For a look

at a sample business ledger sheet for a typical fitness facility, see the

sidebar “Sample Business Ledger Sheet.”

Financial Statements

Financial statements

provide owners, accountants and lending institutions with valuable insights

into a business. If you know how to read and interpret financial documents, you

will know the true “health” of your business. More important, these statements

will help you anticipate and confidently answer lenders’ questions in the event

that you want to grow your business in the future.

You would typically prepare financial statements using

information from your ledger accounts.

Because some financial statements require data from other financial

statements, it helps to prepare them in a logical order:

- income statement

- balance sheet

- statement of owner’s equity

- cash flow statement

Master Budgets

Creating a master

budget allows us to plan for the

future success of our business. Budgets provide direction, motivation to meet

goals, better coordination for all business activities, and resources to

evaluate progress.

A master business budget usually includes an operating budget, a

capital expenditure budget and a financial budget. The operating budget sets the target revenues

and expenses (and ultimately net income) for a particular period of time. The capital

expenditure budget outlines the planned purchases of

property, equipment and other assets. The financial budget

projects the means of raising money from stockholders and creditors, and plans

cash management.

As you prepare your master budget, keep in mind that you are

developing your business’s operating and financial plan for a given period. The

steps in this process may seem mechanical, but remember that budgeting

stimulates thoughts and ideas about pricing, product lines, job assignments,

needs for additional equipment or bank loans to facilitate future growth. Preparation of a budget leads to

decisions that will affect the future course of your business.

Bottom Line

Remember that

the whole purpose of accounting is to provide information that is useful and

relevant, not just to you, but to other interested parties (e.g., your

investors, lenders, bankers, etc.), when it comes to making decisions about the

operation of your business. The common language that allows you to effectively

communicate to all parties what is happening financially in your business is

the language of accounting.

Once you’re familiar with the basic terms and procedures outlined

in this article, you’ll be better prepared to make sense of basic financial

reports and better able to communicate with others about important financial

information. More important, you will have a deeper understanding of just how

fit your business is financially.

SIDBAR:

Glossary

account: a collection of financial information grouped

according to customer or purpose

accounts

payable: the amount of money

that your business owes to others

accounts

receivable: the amount of

money that is owed to your business and you expect to receive

asset: an economic resource that a business owns that is

expected to be of benefit in the future

bad debt: money

owed for a business debt that cannot be collected; it can, however, be deducted

as an operating expense

balance

sheet: a statement listing a

business’s assets, liabilities and net worth, or equity

budget: tool for forecasting a business’s future in

quantifiable amounts, including the quantities of products or services to be

sold and their expected selling prices, the number of employees and their

salaries and an array of other amounts that are ultimately expressed in dollars

capital: another name for the owner’s equity in a business

cash flows: funds

your business receives for products and services sold, plus funds the business

pays out for items such as rent and salaries

chart of

accounts: a list of all the

business accounts and their account numbers in the general ledger

current

asset: an asset that is expected to be

converted to cash, sold or consumed during the next 12 months, or within the

business’s normal operating cycle if longer than 1 year

current

liability: a debt due to be

paid within 1 year or one of the business’s operating cycles if the cycle is

longer than 1 year

fixed costs:

costs that do not change in

total as volume changes

income

statement: a list of a

business’s revenues, expenses and net income/loss for a specific period of time

invoice: a written record of a transaction, often submitted

to a customer or client when requesting payment

ledger: a physical collection of related financial

information, such as revenues, expenditures, accounts receivable and accounts

payable

liability: an economic obligation (debt) payable to someone

outside of the business

net income: gross income less expenses; it represents a

business’s profit for a given year

operating

expenses: expenses, other

than cost of goods sold, that are incurred in the business’s major line of

business (e.g., rent, depreciation, salaries, wages, utilities, supplies, etc.)

receipt: a written record of a business transaction

retained

earnings: the capital that

is earned through the profitable operation of the business

statement: a formal, written summary of unpaid, and sometimes

paid, invoices; generally used more as a reminder to a customer or client that

payment is due or that payment has been made

statement of

cash flow: a report of cash

receipts and cash disbursements classified according to the entity’s major activities

(i.e., operating, investing and financing)

transaction: any event that affects the financial position of a

business and is reliably recorded

variable

costs: costs that change in

direct proportion to changes in business volume or activity

SIDEBAR: SAMPLE BUSINESS LEDGER SHEET

- The owner invested $50,000

cash in the business (see entry 1). - He paid $20,000 cash for

exercise equipment (see entry 2). - He purchased $500 in office

supplies (see entry 3). - He received $5,500 cash from

clients for club memberships (see entry 4). - He performed $3,000 worth of

personal training services for a client (see entry 5). - He paid cash for rent

($1,100); employee salaries ($1,200); utilities ($400) (see entry 6). - He paid $400 on the amount

for office supplies bought in transaction 3 (see entry 7). - He received $1,000 owed to

him from transaction 5 (see entry 8). - He sold equipment for cash

equal to its cost of $6,000 (see entry 9). - He withdrew $2,100 cash for

personal living expenses (see entry 10).

GENERAL LEDGER SHEET

SIDEBAR: Additional Resources

- Introduction to Accounting: An Integrated

Approach with NetTutor & PowerWeb Package by Penne Ainsworth and

Dan Deines (McGraw-Hill/Irwin 2003): good accounting book for beginning and

intermediate accounting topics; offers numerous examples at the end of each

chapter. - Intermediate Accounting (with Thomson

Analytics) by James Stice, Earl K. Stice and Fred Skousen

(South-Western College Publishers 2004): presents accounting from the

perspective of the essential activities of business: operating, investing and

financing. - Accounting by Carl S. Warren

(South-Western Educational Publishing 2001): the authors adapt their proven

approach to accounting’s evolving role in business and use the preparation of

financial statements as the framework for understanding what accounting is all

about. - Accounting 1–26 and Integrator CD

(6th ed.) by Charles T. Horngren, Walter T. Harrison and Linda S.

Bamber (Prentice Hall 2004): this introduces readers to all the key financial

and management accounting concepts, citing actual examples from companies such

as Target, Oracle and a variety of companies doing e-business.

- So, You Want to Learn Bookkeeping! by

Bean Counter’s Dave Marshall (www.dwmbeancounter.com/tutorial/tutorial.html):

free bookkeeping tutorial geared to business owners, managers and individuals

who have not had any formal bookkeeping training or on-the-job experience, and

who need or want to learn the basics of bookkeeping. - Accounting 101: The

Fundamentals/Kutztown University of Pennsylvania Small Business Development

Center (www.kutztownsbdc.org/course_listing.asp): an e-learning site with one

of the largest collections of free entrepreneurial training resources available

on the Internet. - Accounting Information at

www.business.com (www.business.com/directory/accounting/): a directory of

information and resources for accounting professionals, including data on

accounts payable, accounts receivable, asset analysis, budgeting and

forecasting, financial statements, payroll accounting and taxes. - SmartPros Accounting

(www.smartpros.com/): a resource for accounting professionals or anyone

interested in accounting; the site covers news, research, products and online

interactions with accounting professionals. - Understanding Financial

Statements (www.bizzer.com/images/financial/index.html): this website provides

an introduction to financial statements and financial statement concepts. Some

of the concepts covered are the accounting equation,double-entry accounting,

and debits and credits. - Principles of Accounting

(www.principlesofaccounting.com/default.htm): a free online accounting textbook

for reviewing accounting principles. -

Small Business Bookkeeping

& Accounting (www.waybuilder.net/sweethaven/business/bookaccount/bookkeeping01_TOC.asp):

a free short course that introduces you to a variety of accounting events

related to such business activities as setting up your records and bank

accounts, preparing for a loan request or developing a financing plan.

Tom

Perkins is a fitness business coach/adviser; a radio host, speaker and author;

and a certified personal trainer and nutritionist. He holds a degree in

business management/accounting and has been involved in fitness businesses for

more than 30 years. Contact him at www.megafitnessbusiness.com.